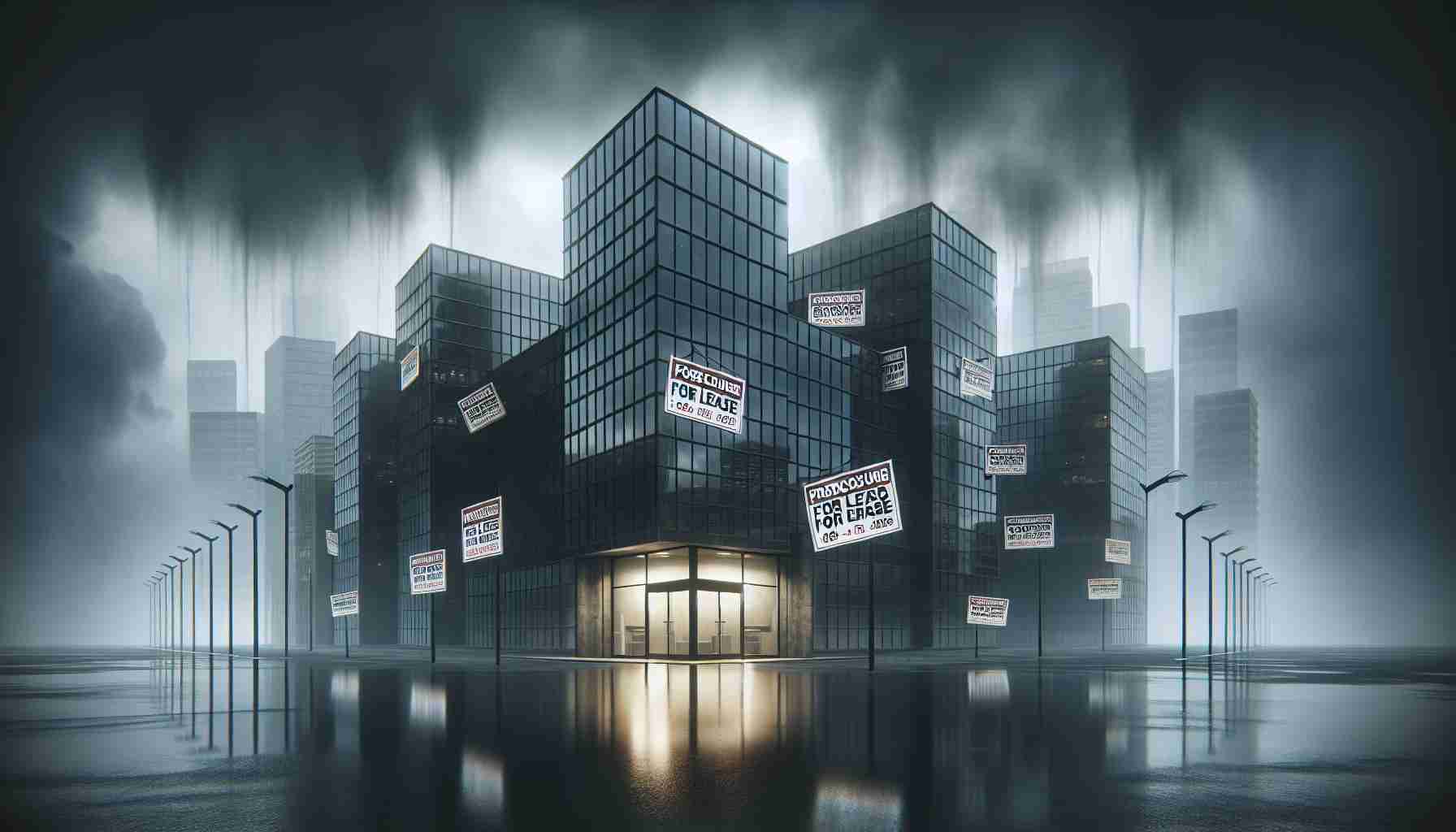

Commercial Real Estate Faces Troubling Times! Record Foreclosures Signal Market Shifts

The State of Commercial Real Estate in 2024

The landscape of America’s commercial real estate sector has revealed alarming trends as we move through 2024. Recent analysis from ATTOM indicates a striking 48% increase in foreclosure activity within the last quarter, marking a dismal year-end, with September alone witnessing 695 foreclosures.

Among the states, California stands out with the highest foreclosure figures, accounting for 264 of the September cases, demonstrating a staggering 238% rise compared to the previous year. Close behind, New York recorded 95 foreclosures, reflecting a significant surge of 58% from prior months.

As economical challenges loom, experts have been particularly wary of the outstanding commercial debts. Notably, $700 billion worth of commercial loans are set to mature throughout 2024, raising concerns about potential fallout. Economists predict further distress as an estimated $2.2 trillion in commercial debt will mature by 2027.

Investment strategies among developers are currently characterized by cautious optimism, where many lenders are opting to extend terms in hopes of market recovery. However, indications suggest that this might not be sustainable, as the pressure to inject new capital intensifies.

As foreclosures continue to climb, the implications for investors are significant. Keeping abreast of these changes is essential for anyone contemplating long-term investment in commercial real estate. Seek guidance from financial advisors to navigate these turbulent waters effectively.

Commercial Real Estate: Trends, Impacts, and the Path Ahead

The commercial real estate (CRE) sector is currently navigating a tumultuous period, marked by a 48% surge in foreclosure activity through 2024. The foreclosures are symptomatic of deeper economic woes, particularly highlighted by the disconcerting figures seen in states such as California and New York. As we take a closer look, it’s essential to analyze how these developments affect the environment, humanity, the economy, and ultimately, the future of our planet.

One area of concern is the impact of such a steep rise in commercial foreclosures on urban environments and communities. With foreclosures come vacant properties, which can lead to neglected spaces that potentially become hotspots for crime, environmental degradation, and economic decline. These abandoned buildings often require significant resources for rehabilitation, diverting funds that could be used for other community benefits or sustainability initiatives.

From an environmental perspective, the increase in vacant commercial properties could lead to greater resource waste. Properties that are left unattended can become sites for unregulated waste disposal, or worse, become hazardous due to lack of maintenance. When commercial buildings languish, their deterioration can release harmful substances into the local environment, impacting air and water quality. This, in turn, can adversely affect public health, which ties back into broader humanitarian concerns.

Economically, the looming maturity of $700 billion in commercial loans throughout 2024 creates a precarious balance for investors and lenders alike. If a significant portion of these loans goes into default, it could lead to a major credit crunch, tightening financial flows to businesses that rely on lending for operational longevity and growth. Small and medium enterprises—often the backbone of local economies—could struggle to access necessary funds, exacerbating poverty and unemployment rates.

Moreover, the predicted repayment burden of $2.2 trillion by 2027 suggests a forthcoming crisis that may reshape the investment landscape and influence housing and commercial market dynamics. Should the market fail to recover, the resulting economic downturn could restrict job opportunities, further deteriorating living standards.

Looking forward, the increase in commercial foreclosures and the resulting economic strain may prompt a shift in how urban development and investment strategies are approached. It may encourage environmentally sustainable practices, such as repurposing existing structures instead of new builds, which would mitigate overall ecological impacts. As long-term investors become acutely aware of these risks, there is potential to shift capital towards projects that prioritize resilience and sustainability.

The current trajectory of the CRE sector serves as a concerning bellwether for humanity’s broader economic future. Communities may need to prioritize rebuilding and reinforcing local economies through sustainable practices, advocating for policies that ensure equitable access to resources, and promoting innovative urban development models that address both economic and environmental crises.

In conclusion, as the situation within the commercial real estate market evolves, it is crucial for stakeholders—from investors to policymakers—to reconsider their strategies. The challenges presented can alert us to the interconnectedness of economic stability, environmental stewardship, and community welfare. Addressing these impending challenges head-on will be vital not only for the recovery of the commercial real estate market but for the sustainable future of humanity itself.

Unraveling the Challenges and Opportunities in Commercial Real Estate for 2024

The State of Commercial Real Estate in 2024

The landscape of America’s commercial real estate (CRE) sector is facing significant challenges as we progress through 2024. Recent analyses have shown alarming trends, particularly regarding foreclosure activity and the looming maturity of commercial debt, which could have far-reaching implications for the market.

Current Trends in Foreclosures

Recent data from ATTOM highlights a shocking 48% increase in foreclosure activity in the last quarter, signaling a troubling trend as we approach the year’s end. In September alone, there were 695 foreclosures, with California leading the pack, accounting for 264 cases. This represents a staggering 238% increase compared to the previous year. New York follows closely, experiencing a 58% rise with 95 foreclosures reported in the same month.

Insights on Commercial Debt

One of the most pressing issues in the CRE sector is the maturity of commercial loans. A staggering $700 billion in commercial loans is set to mature in 2024, raising concerns among economists about potential market instability. Furthermore, projections indicate that an alarming $2.2 trillion in commercial debt will mature by 2027. This looming debt maturity is critical for investors to consider, as it could lead to an increase in foreclosures and distressed assets if not managed properly.

Investment Climate and Strategies

In this uncertain landscape, investment strategies among commercial property developers reflect a cautious optimism. Many lenders are opting to extend loan terms in an attempt to weather the storm and facilitate a potential market recovery. However, the sustainability of this approach is being questioned, as the pressure to inject new capital intensifies.

Pros and Cons of Investing in Commercial Real Estate

# Pros:

– Potential for High Returns: Despite the current challenges, successful investments in CRE can yield significant returns.

– Diversification: Adding commercial properties to an investment portfolio can offer diversification benefits.

– Tax Benefits: Investors can take advantage of depreciation and other tax incentives.

# Cons:

– High Risk: The current market volatility poses a considerable risk to investors.

– Liquidity Issues: Commercial properties are less liquid compared to residential properties, making quick sales challenging.

– Regulatory Challenges: Navigating the regulatory landscape can be complex and time-consuming.

Recommendations for Investors

With the current state of foreclosures and impending commercial debt maturities, it is crucial for investors to stay informed. Consulting with financial advisors is recommended to navigate these complexities effectively. Additionally, exploring alternative investment structures, such as Real Estate Investment Trusts (REITs), may offer safer avenues for diversification in these turbulent times.

Conclusion

The commercial real estate market is at a critical juncture in 2024, with rising foreclosures and looming debt maturities posing significant challenges. Investors must maintain vigilance and adaptability in their strategies to weather these changes and seize potential opportunities for growth.

For more insights into the evolving commercial real estate market and strategies for effective investing, visit ATTOM.