- Bali offers affordable investment opportunities with strong rental yields and low entry costs.

- Key locations in Bali, such as Uluwatu and Canggu, are attracting investor interest.

- Sustainability and eco-friendly property options are becoming increasingly important in Bali.

- Phuket is recognized for its luxury real estate market, appealing to high-net-worth investors.

- The availability of freehold property options and strong infrastructure enhances Phuket’s investment appeal.

- Both islands present unique advantages tailored to different investment strategies and goals.

- Prospective investors should consider their objectives when choosing between Bali and Phuket.

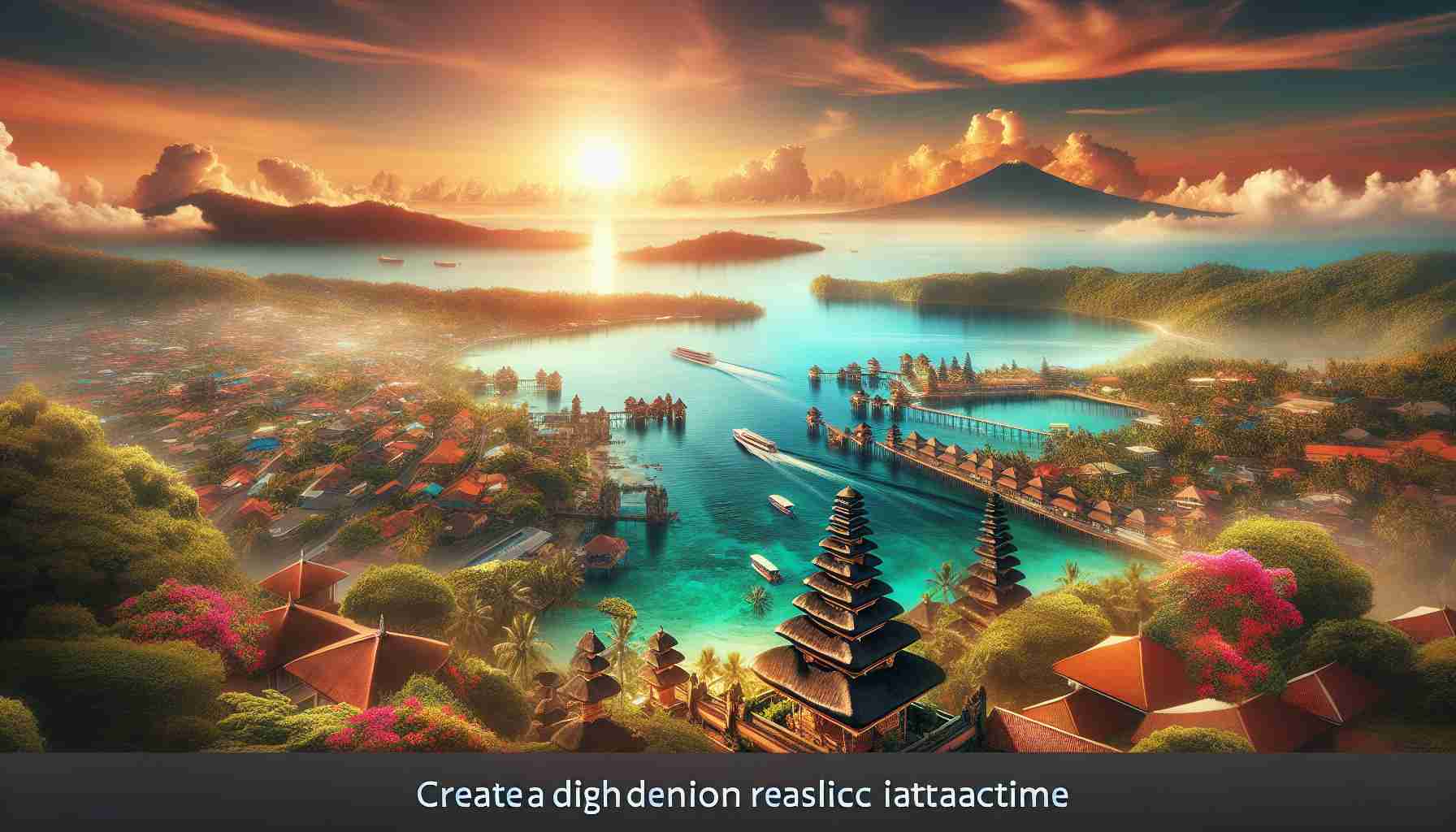

As the property investment landscape shifts across Asia, two stunning islands—Bali and Phuket—are seizing the spotlight, luring investors with their unique offerings and breathtaking locales.

Bali, with its pristine beaches and vibrant culture, is emerging as a hotspot for affordable investments. Investors are flocking to areas like Uluwatu and Canggu, attracted by enticing rental yields and relatively low entry costs. Recent infrastructure developments, including the upcoming North Bali International Airport, promise to enhance accessibility, making this tropical paradise even more appealing. Bali’s commitment to sustainability, featuring eco-friendly and wellness-focused properties, also resonates with modern trends. However, prospective buyers should note that the island’s reliance on leasehold structures could impact long-term value retention.

In contrast, Phuket epitomizes luxury real estate, drawing high-net-worth individuals enamored with its upscale properties. Investors appreciate the island’s freehold options and robust infrastructure. With ongoing projects improving accessibility and discussions about legal casinos igniting excitement, Phuket stands as a symbol of stability and growth. Picturesque beachfront villas in Kamala and sleek condos in Patong are redefining opulent living, ensuring that the demand for premium properties remains strong.

Both Bali and Phuket showcase the thriving diversity of Asia’s real estate sector, offering distinct advantages depending on investor goals. Whether you seek quick returns in Bali or wish to establish long-term value in Phuket, these islands present a golden opportunity for savvy investors. With the right insights and guidance, the key to unlocking your next investment awaits in these tropical havens.

Unlocking Investment Potential: Bali vs. Phuket – What You Need to Know!

As the property investment landscape continues to evolve across Asia, two stunning islands—Bali and Phuket—are at the forefront, offering unique opportunities for investors. Each island boasts attractive features, and understanding their distinct offerings can significantly influence investment decisions.

Emerging Trends in Bali and Phuket

1. Market Trends and Insights

– Bali is witnessing a rise in digital nomadism, leading to increased demand for short-term rental properties. The island has been fostering a community that supports remote work, benefiting from the influx of foreign investors eager to capitalize on this trend.

– Phuket is becoming favored for its luxury retirement estates as more individuals look to relocate and enjoy a high-quality lifestyle in a serene environment. The integration of health and wellness amenities in real estate projects aligns with the growing demand for holistic living.

2. Sustainability Practices

– Bali is enhancing its appeal with eco-luxury properties that focus on sustainability. This shift caters to environmentally conscious investors who prioritize green living solutions, such as solar-powered villas and organic design principles.

– Phuket is promoting sustainable tourism and property development, with initiatives aimed at minimizing environmental impact through smart technology in buildings and renewable energy sources.

3. Innovations in Property Development

– Both islands are pioneering smart home technologies that include home automation for security, energy efficiency, and enhanced living experiences, making investments more attractive to tech-savvy buyers.

Key Market Forecasts

– Bali is expected to see a growth rate in rental prices of approximately 7-10% annually over the next five years, driven by increasing tourism and infrastructural developments, such as improved connectivity and attractions.

– Phuket, with its luxury market, is likely to maintain price stability and be a strong investment avenue, with projections suggesting a 5% annual increase in property value, particularly in high-demand areas.

The Pros and Cons of Investing in Bali and Phuket

Bali:

– Pros: Low entry costs, high rental yields, vibrant culture.

– Cons: Leasehold system may affect long-term investments.

Phuket:

– Pros: Freehold ownership, luxury market stability, high demand for upscale properties.

– Cons: Higher entry costs and leaning toward a saturated luxury market in some areas.

Frequently Asked Questions

Q1: What are the key differences in real estate ownership between Bali and Phuket?

A1: In Bali, most foreign investors purchase leasehold agreements, limiting the duration of ownership. In contrast, Phuket offers freehold options for foreigners, allowing full ownership of the property, which is particularly appealing for long-term investors.

Q2: What kind of rental yields can investors expect in Bali?

A2: Investors in Bali can anticipate rental yields ranging from 8% to 12%, especially in popular tourist areas, owing to the high demand for holiday rentals.

Q3: Is it advisable to invest in luxury properties in Phuket?

A3: Yes, investing in luxury properties in Phuket remains advisable, particularly given the strong demand from foreign buyers and retirees. However, buyers should conduct thorough market research to identify the best investment opportunities.

Conclusion

Bali and Phuket each present distinct advantages for property investors, shaped by their unique offerings and current market trends. With sustainability in focus and evolving property technologies, these islands are at the intersection of luxury and eco-conscious living.

For more insights into property investment trends, visit Property Guru for detailed analyses and updates.

By considering these factors, investors can strategically navigate the vibrant real estate landscapes of these two tropical havens.