- The REIT market is experiencing significant changes, driven by private equity firms targeting undervalued assets.

- In 2024, seven REITs were acquired at substantial premiums, reflecting a high demand for mergers and acquisitions.

- The average discount to net asset value (NAV) for REITs has increased to 35.6%, indicating potential investment opportunities.

- Despite a rise in share price, companies like PRS REIT still face challenges with significant discounts to NAV.

- Growing demand for rental properties amid a housing crisis is boosting occupancy and rental rates, beneficial for REITs focused on this sector.

- As larger REITs seek to acquire smaller firms, the competition for promising investment prospects is intensifying.

The real estate investment trust (REIT) landscape is undergoing a seismic shift. After enduring a brutal two-and-a-half-year market slump, these property giants are now prime targets for ravenous private equity firms eager to snap up undervalued assets. In 2024 alone, seven REITs were snatched up at jaw-dropping premiums, as share prices spiraled downwards alongside surging gilt yields.

The appetite for M&A activity is insatiable, with heavyweights like Kennedy Wilson and the Canada Pension Plan diving into lucrative deals as the average discount to net asset value (NAV) soared to 35.6%. Companies like PRS REIT, despite boasting a hefty portfolio valued at £1.14 billion, are finding themselves vulnerable after disappointing shareholders. With a recent 14% rise in its share price, it still trades at a staggering 19% discount to NAV, indicating a potential bargain for future buyers.

As the UK’s housing crisis deepens, demand for rental properties escalates. The PRS REIT’s rental portfolio flourishes, with occupancy hitting 97% and rents climbing 11% in 2024. Challenges in homeownership continue to drive people towards renting, making properties like PRS increasingly coveted.

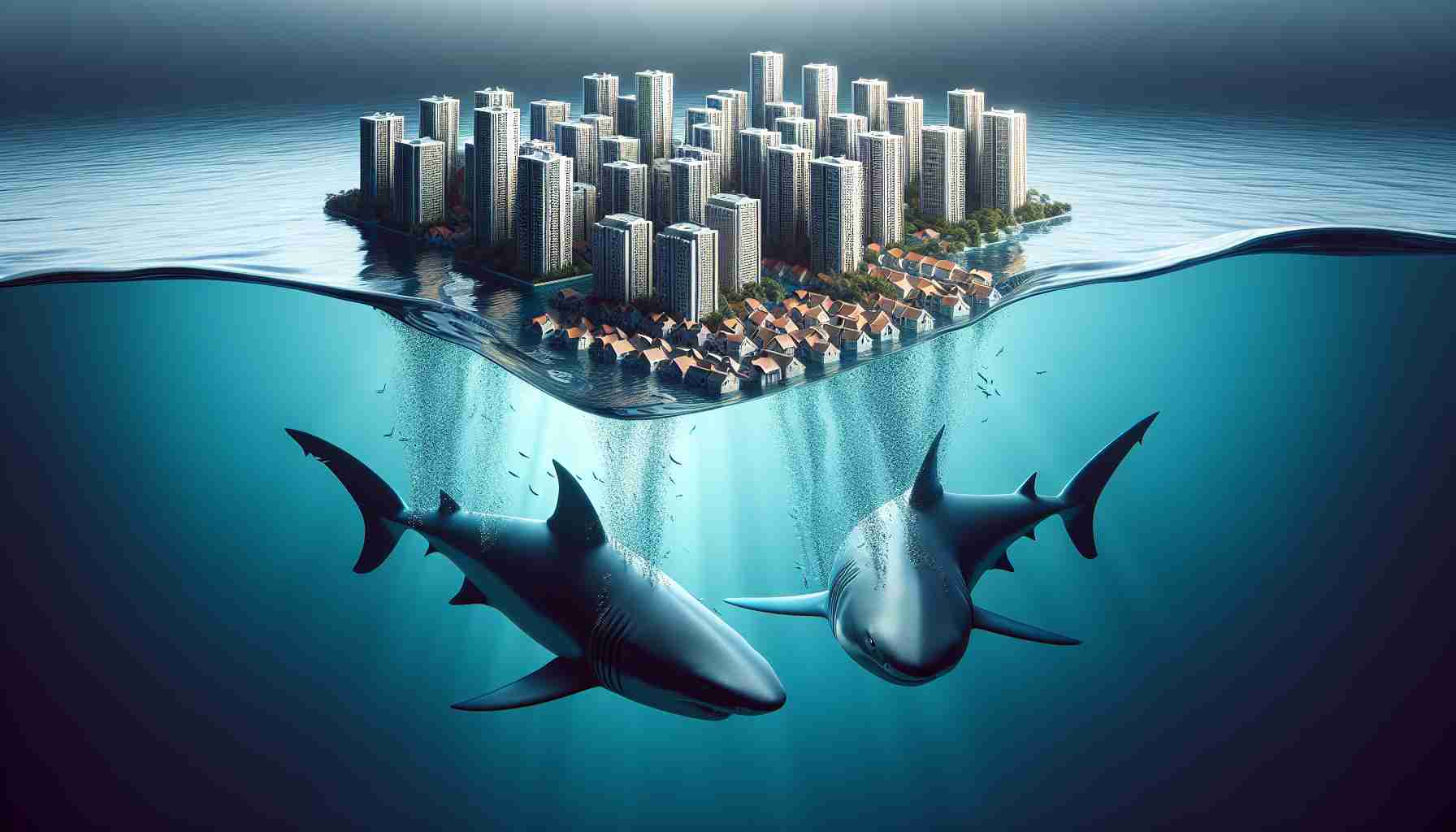

But it’s not just private equity on the prowl. Larger REITs are eyeing smaller players to beef up their portfolios, and the most intriguing targets are emerging. With a dwindling number of candidates, the race to acquire these property giants is heating up—a true feeding frenzy in the depths of the real estate ocean.

The key takeaway? The tumultuous real estate waters are rife with opportunity for savvy investors. Keep an eye on the sharks circling; they’re ready to strike at any moment!

Profiting from the REIT Frenzy: Insights and Predictions for 2024

Understanding the Current Landscape of REITs

The real estate investment trust (REIT) sector is experiencing significant transformation influenced by economic factors and shifting market dynamics. After a steep decline over the past two and a half years, REITs are increasingly viewed as attractive acquisition targets by private equity firms. This surge in M&A (mergers and acquisitions) activity is characterized by notably high premiums paid for acquisitions.

Market Trends and Insights

1. Surge in Acquisitions:

– In 2024, seven REITs were acquired at impressive premiums, indicating a ravenous appetite for undervalued assets. The average discount to net asset value (NAV) currently stands at 35.6%, making many REITs prime targets for acquisition.

2. Occupancy and Rental Trends:

– Demand for rental properties is soaring against the backdrop of the UK’s worsening housing crisis. The PRS REIT, for example, has benefited from this trend, boasting a 97% occupancy rate and a remarkable 11% increase in rents in 2024.

3. Elegance of Larger Players:

– Larger REITs are actively searching for smaller REITs to enhance their portfolios, leading to fierce competition among buyers. This consolidation trend highlights the limited number of viable acquisition candidates, signaling potential for further market shifts.

Key Questions Answered

1. What are the primary factors driving the current REIT acquisition trend?

– The main factors include depressed share prices, high NAV discounts, and intense competition from private equity firms. As housing demand remains high and occupancy rates stabilize, investors see opportunities for growth and profitability through acquisitions.

2. How does the current economic climate affect rental property demand?

– Economic instability and challenges in homeownership are pushing individuals towards the rental market. As the housing crisis deepens, more people are seeking rental options, directly benefiting REITs focused on residential properties.

3. What does the future hold for REITs in light of these trends?

– The future of REITs appears strongly aligned with mergers and acquisitions, especially as market conditions fluctuate. Innovations in proptech and sustainability in property management might influence investment decisions, creating new opportunities while establishing a competitive landscape.

Key Features of the Changing REIT Market

– Innovations: Technological advancements in property management and investment analysis are being embraced by REITs, enhancing operational efficiencies.

– Sustainability: A growing focus on sustainable development practices is reshaping investment criteria, with environmentally conscious properties gaining traction.

– Pricing Trends: With ongoing acquisitions, pricing dynamics may shift significantly, reflecting the increased enthusiasm and investment capacity of larger corporate players and private equity firms.

Conclusion

The REIT market is undergoing a transformative phase marked by strategic acquisitions, rising rental demand, and an evolving investor landscape. Savvy investors who can navigate these turbulent waters stand to profit significantly. Keep an eye out for potential opportunities as the landscape continues to change.

For more information on the REITs market, visit National Association of Real Estate Investment Trusts.