Rewolucja elektrycznych rowerów jest w pełnym rozkwicie. Globalny rynek e-bike’ów ma potężny potencjał wzrostu, z prognozowanym wzrostem o wartości 16,48 miliarda dolarów w latach 2024-2028, zgodnie z badaniami firmy Technavio. Przewiduje się, że rynek ten będzie rósł z roczną stopą wzrostu (CAGR) wynoszącą ponad 6,95% w okresie prognozowym. Wzrost popularności e-bike’ów można przypisać różnym czynnikom, takim jak integracja funkcji łączności oraz regulacje rządowe promujące ekologiczne opcje transportu.

E-bike’i pojawiły się jako zrównoważone rozwiązanie dla osobistej mobilności, zwłaszcza w obszarach miejskich. Dzięki integracji funkcji łączności, te elektryczne dwukołowce oferują śledzenie lokalizacji w czasie rzeczywistym, zbieranie danych oraz możliwości analizy danych. Funkcje takie jak wspomaganie pedałowe i kontrola gazu zaspokajają różne potrzeby użytkowników, zapewniając zróżnicowany poziom wsparcia oraz kontroli. E-bike’i stały się popularne wśród młodych dorosłych, mężczyzn i organizacji rowerzystów, oferując korzyści takie jak redukcja emisji CO2, oszczędność czasu i poprawa jakości powietrza.

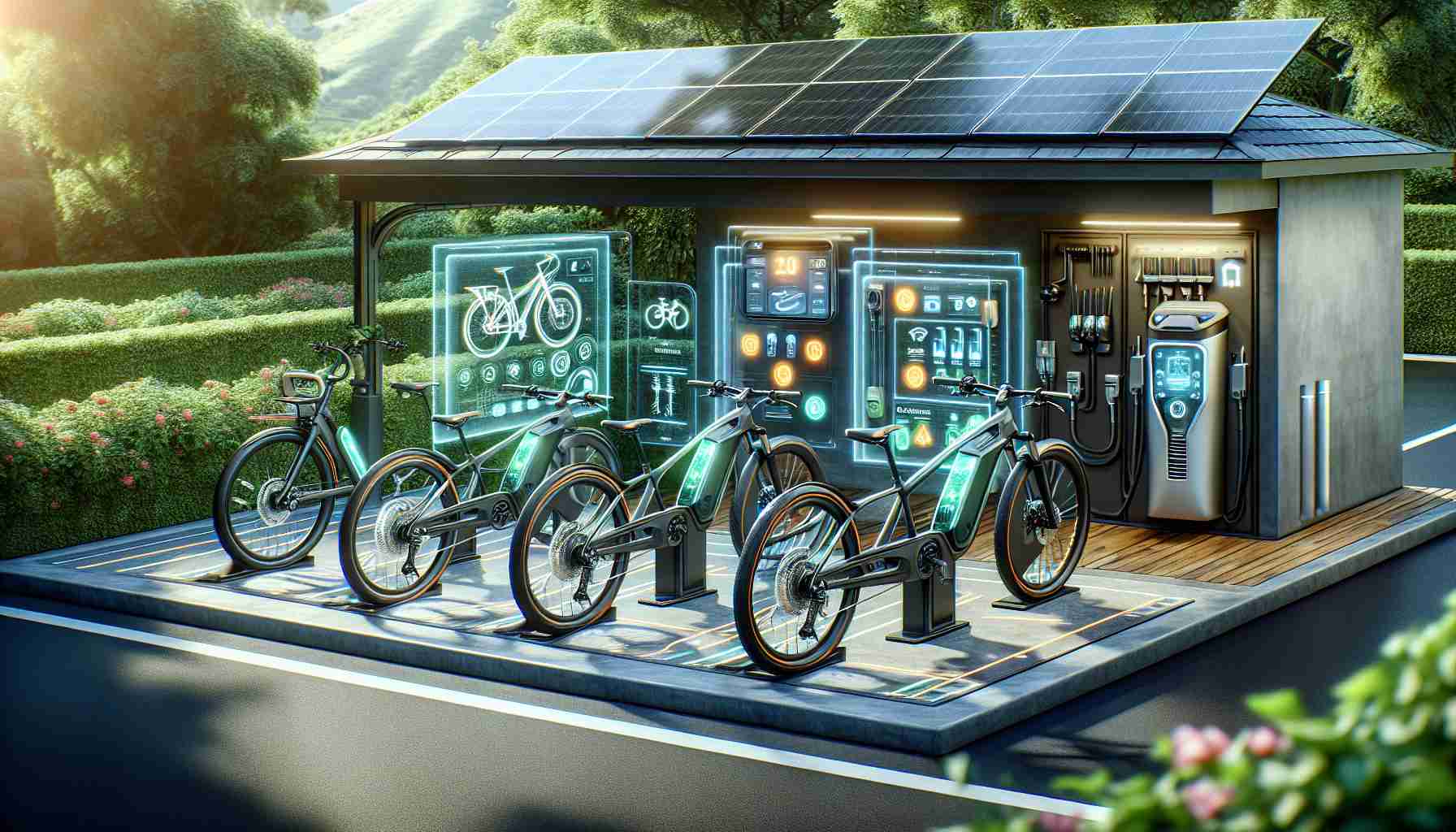

Pomimo licznych zalet, rynek e-bike’ów stoi przed wyzwaniami. Ograniczenia infrastrukturalne, takie jak brak ścieżek rowerowych i stacji ładowania, utrudniają powszechne przyjęcie e-bike’ów. Jednak rządy i organy regulacyjne na całym świecie coraz bardziej zachęcają do korzystania z e-bike’ów poprzez regulacje oraz inicjatywy rozwoju infrastruktury.

Rynek jest rozdrobniony, a kluczowe podmioty obejmują Accell Group NV, Giant Manufacturing Co. Ltd. oraz Yamaha Motor Co. Ltd. Te firmy skupiają się na poprawie jakości budowy, osiągów i innowacji, natomiast zachęty cenowe przyciągają rowerzystów w zatłoczonych obszarach miejskich. Technologia baterii odgrywa również kluczową rolę na rynku e-bike’ów. Podczas gdy e-bike’i wyposażone w akumulatory kwasowo-ołowiowe dominują na rynku ze względu na ich dostępność i niezawodność, obecnie obserwuje się rosnące zainteresowanie wydajniejszymi i mocniejszymi akumulatorami litowo-jonowymi.

Podsumowując, rewolucja e-bike’ów definiuje nową erę osobistej mobilności. Dzięki postępom technologicznym, wsparciu rządowemu oraz silnym naciskom na zrównoważony rozwój, e-bike’i staną się kluczową częścią ekosystemu Mobility-as-a-Service. Wraz z dalszym wzrostem rynku, producenci inwestują w innowacje, aby sprostać zmieniającym się potrzebom konsumentów, oferując zrównoważony i ekonomiczny środek transportu w obliczu problemów środowiskowych i zmieniającej się dynamiki rynkowej.