Mentre la popolarità delle biciclette elettriche continua a crescere negli Stati Uniti, le preoccupazioni sulla sicurezza delle batterie al litio delle e-bike sono cresciute anch’esse. Tuttavia, recenti sviluppi in Cina potrebbero avere un impatto significativo nell’aumentare la sicurezza antincendio delle e-bike.

Gli incendi delle batterie delle e-bike, sebbene rari, sono diventati un problema di rilievo negli Stati Uniti. In particolare, la città di New York ha attirato l’attenzione a causa della grande popolazione di fattorini delle e-bike che spesso utilizzano batterie cinesi di bassa qualità. Mentre è importante mantenere questa preoccupazione in prospettiva, considerando che a New York ci sono più decessi causati dagli incendi dei termosifoni, la crescita significativa dell’uso delle e-bike rende necessario un maggiore accento sulla sicurezza antincendio.

Riconoscendo che la maggior parte degli incendi delle batterie è causata da batterie cinesi di scarsa qualità destinate a e-bike ed e-scooter estremamente economici, il governo cinese ha preso provvedimenti per affrontare questo problema. Il Paese ha recentemente introdotto nuovi standard tecnici che regolano il design, la produzione e la vendita delle batterie al litio utilizzate nei dispositivi di micromobilità.

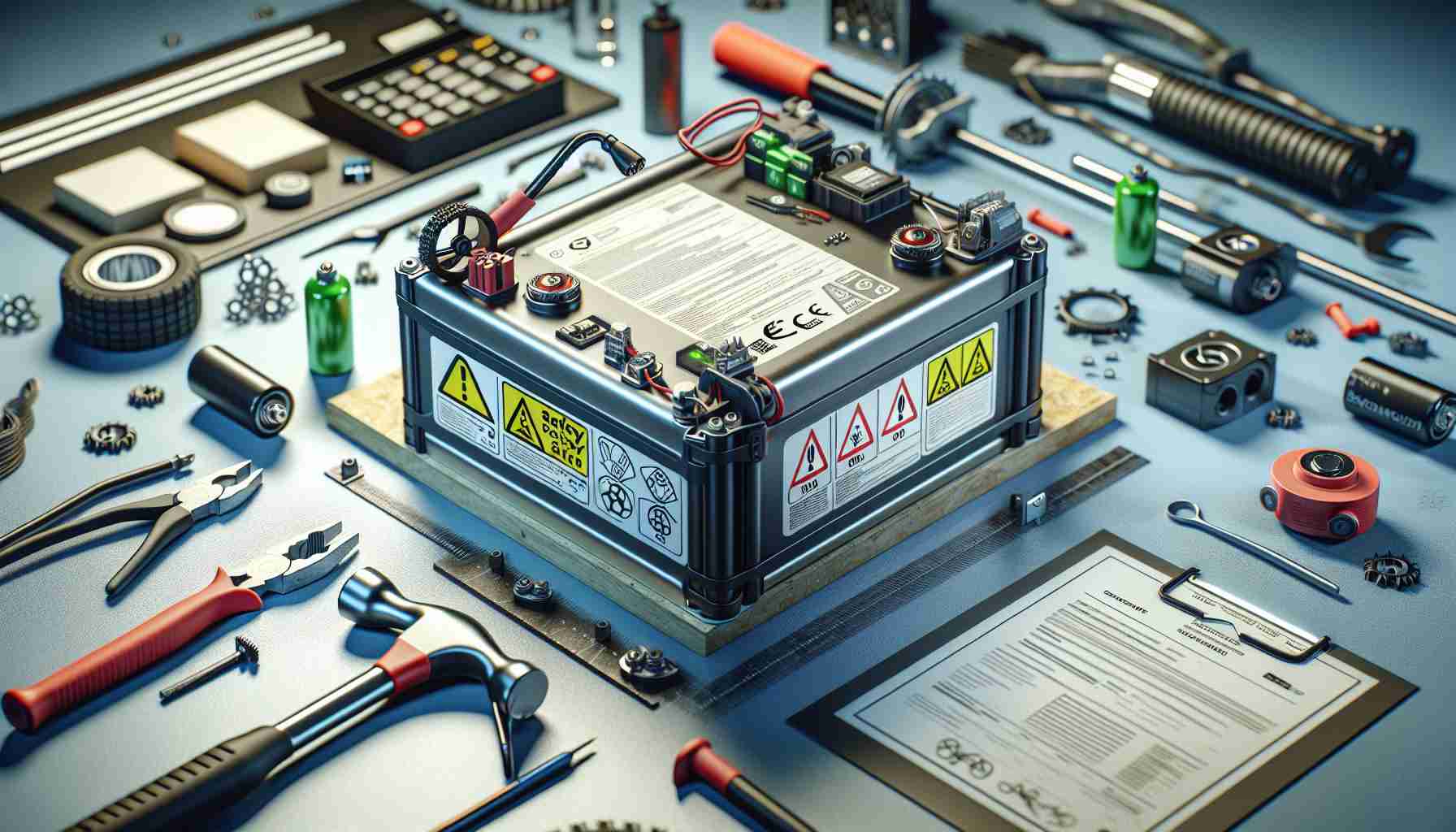

Queste normative sulla sicurezza, conosciute come “Specifiche tecniche di sicurezza per le batterie al litio utilizzate nelle biciclette elettriche”, affrontano aspetti critici legati alla qualità della produzione e al rischio di incendio. Esse comprendono 22 elementi specifici del design e della produzione della batteria, tra cui sovraccarica, sovrascarica, cortocircuiti esterni, abuso termico e forature della batteria, tra gli altri.

L’applicazione dei nuovi standard partirà dal 1° novembre 2024. Le batterie al litio per le biciclette elettriche saranno vietate in Cina a meno che non siano conformi a queste normative. Sebbene gli standard si applichino attualmente solo al mercato domestico, l’immensa industria delle batterie per e-bike cinese influenzerà probabilmente la produzione globale.

Poiché la maggior parte delle biciclette elettriche e dei loro componenti negli Stati Uniti proviene dalla Cina, ci si aspetta che questi nuovi standard per le batterie ridefiniscano le pratiche di produzione nel paese. I principali fornitori che danno priorità a batterie di alta qualità potrebbero già soddisfare o superare i nuovi standard, mentre i produttori che mettono a rischio la sicurezza per ridurre i costi potrebbero incontrare difficoltà. Le aziende cinesi tendono a conformarsi agli standard normativi e ciò probabilmente spingerà i produttori di batterie a migliorare il loro design, a sospendere la produzione o a passare ad altri settori.

Sebbene le normative si rivolgano principalmente al mercato interno, è improbabile che si mantengano linee di produzione separate per le batterie destinate all’esportazione. Pertanto, l’aumento degli standard di produzione per le batterie delle e-bike locali potrebbe avere un impatto positivo anche sulle batterie destinate all’export. In definitiva, questi nuovi standard di sicurezza rappresentano un passo significativo per affrontare le preoccupazioni legate agli incendi delle batterie delle e-bike e migliorare la sicurezza complessiva delle biciclette elettriche.